GST Panel to Review Insurance Tax Rates, Report by Oct 30

The members of the panel include members from Uttar Pradesh, Rajasthan, West Bengal, Karnataka, Kerala, Andhra Pradesh, Goa, Gujarat, Meghalaya, Punjab, Tamil Nadu and Telangana

PTI

-

18 per cent of Goods and Services Tax (GST) is levied on insurance premiums.PHOTO:PTI

New

Delhi, 15 Sept

The GST

Council on Sunday constituted a 13-member Group of Ministers (GoM) to suggest

GST rate on premiums of various health and life insurance products and submit

its report by October 30.

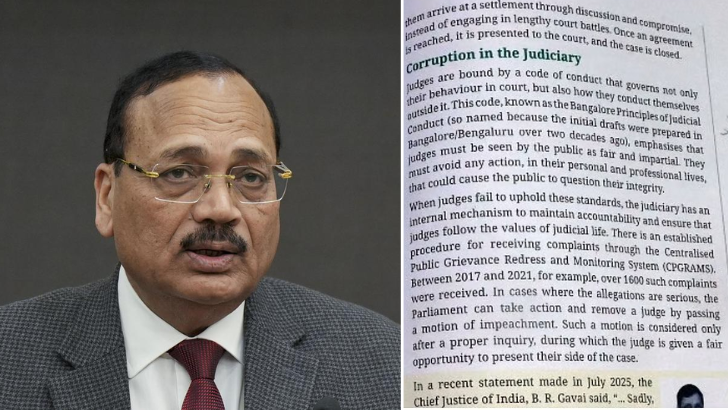

Bihar

Deputy Chief Minister Samrat Choudhary is the convenor of the GoM. The members

of the panel include members from Uttar Pradesh, Rajasthan, West Bengal,

Karnataka, Kerala, Andhra Pradesh, Goa, Gujarat, Meghalaya, Punjab, Tamil Nadu

and Telangana.

The 54th

GST Council meeting on September 9 decided to set up a GoM to examine and

review the present tax structure of GST on life and medical insurance. A final

call by the Council on the taxation of insurance premiums is likely to be taken

in the next meeting in November based on the GoM report.

Currently,

18 per cent of Goods and Services Tax (GST) is levied on insurance premiums.

The Terms

of Reference (ToR) of the panel also include suggesting tax rate of

health/medical insurance including individual, group, family floater and other

medical insurance for various categories like senior citizens, middle class,

persons with mental illness. Also, suggest tax rates on life insurance,

including term insurance, life insurance with investment plans whether

individual or group and re-insurance.

"The

GoM is to submit its report by October 30," 2024," said the Office

Memorandum issued by the GST Council Secretariat on the Constitution of GoM on

Life and Health insurance.

Some

opposition-ruled states, including West Bengal, had demanded complete exemption

of GST on health and life insurance premiums, while some other states were in

favour of lowering the tax to 5 per cent. Even Transport Minister Nitin Gadkari

had in July written to Finance Miniter Nirmala Sitharaman on the issue saying

"levying GST on life insurance premium amounts to levying tax on the

uncertainties of life."

In 2023-24,

the centre and states collected Rs 8,262.94 crore through GST on health

insurance premiums, while Rs 1,484.36 crore was collected on account of GST on

health reinsurance premiums.

Sitharaman

in her reply to a discussion on the Finance Bill in the Lok Sabha in August had

said that 75 per cent of the GST collected goes to states and the Opposition

members should ask their state finance ministers to bring the proposal to the

GST Council.-PTI

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)