SC allows states to seek tax dues on minerals from 2005

CJI Chandrachud said by a 8:1 majority, this court had on 25 July answered the questions referred to it and held that legislative power to tax mineral rights vests with states

PTI

-

Representative Picture

New Delhi, 14 Aug

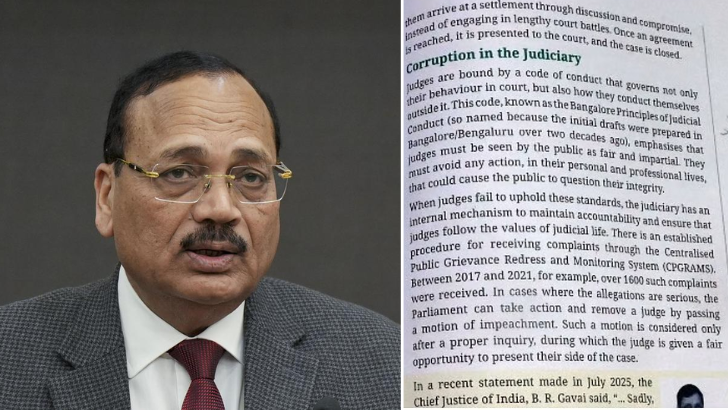

In a major victory for mineral-rich states, the Supreme Court on Wednesday allowed them to seek dues from 1 April, 2005 on royalty and tax on mineral rights and mineral-bearing land from the Centre in a staggered period of 12 years.

A nine-judge Constitution bench headed by Chief Justice DY Chandrachud said the argument for prospective effect of 25 July is rejected. Pronouncing the verdict on behalf of the bench, CJI Chandrachud said by a 8:1 majority, this court had on 25 July answered the questions referred to it and held that legislative power to tax mineral rights vests with states.

He said after the

pronouncement of the 25 July verdict, the assessees sought prospective effect

of the decision and the matter was listed on 31 July to decide the effect of

verdict. The Centre has opposed the demand of states for refund of royalty

levied on mines and minerals since 1989, saying it will impact the citizens and

the PSUs will have to empty their coffers by Rs 70,000 crore according to

initial estimates.

"The

submission that the Mineral Area Development Authority Act (MADA July 25

verdict) be given prospective effect is rejected," the bench said and laid

down conditionalities for payment of dues by the Centre and mining companies,

including Public Sector Undertakings, to the states. "While the states may

levy or renew demands of tax, if any pertaining to Entries 49 and 50 of List II

of seventh schedule of the Constitution, in terms of law laid down in the

decision of MADA (July 25 verdict). The demand of tax shall not operate on

transactions made prior to April 1, 2005," the bench said.

Entry 49 of List

II deals with taxes on lands and buildings while Entry 50 deals with taxes on

mineral rights subject to any limitations imposed by Parliament by law relating

to mineral development.

The bench also

comprising justices Hrishikesh Roy, Abhay S Oka, JB Pardiwala, Manoj Misra,

Ujjal Bhuyan, Satish Chandra Sharma and Augustine George Masih, said “the time

for payment of demand of tax (by states) shall be staggered in instalments over

a period of 12 years commencing from 1 April, 2026”.

The top court

directed that the levy of interest and penalty on demands of taxes by states

from the Centre and mining companies made before the period of July 25, 2024

shall stand waived for all the assessee. CJI Chandrachud said this verdict will

be signed by eight-judges of the bench who by majority decided the 25 July judgement

giving the state’s power to levy taxes on mineral rights.

He said Justice

Nagarathna will not sign Wednesday's verdict as she had given a dissenting view

in the 25 July verdict.

Senior advocate

Rakesh Dwivedi, appearing for Jharkhand, said there still remains one issue

that the state’s Act to collect royalty on minerals and mineral-bearing land,

which was set aside needs to be upheld. "Unless the Act is declared valid,

we cannot collect taxes on minerals and mineral-bearing land. Please list it

expeditiously before the appropriate bench," Diwvedi, who appeared along

with senior advocate Tapesh Kumar Singh for Jharkhand, said.

Dwivedi was

referring to the decision of Ranchi bench of the Patna High Court that had

struck down Section 89 of the Mineral Area Development Authority Act of 1992

vide its judgment dated 22 March, 1993. Section 89 of the Mineral Area

Development Authority Act empowered the state government of then undivided Bihar

to levy tax on not only mineral-bearing land but also land used for commercial

or industrial purposes.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)