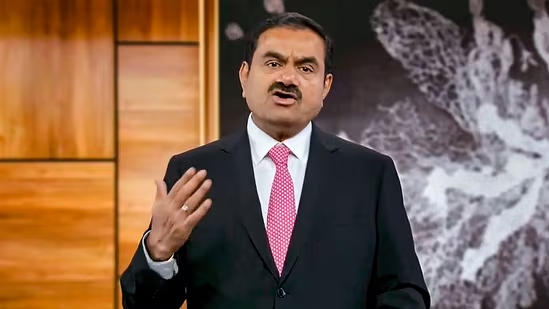

CBI books Anil Ambani's RCOM for Rs 2,000-cr bank fraud

The agency is carrying out searches at the residence of Anil Ambani and premises linked to RCOM in connection with the case.

PTI

-

Reliance Communications and its promoter director Anil Ambani

New Delhi/Mumbai, 23 August

The CBI searched the Mumbai residence of Reliance Communication Ltd.

(RCOM) Director Anil Ambani on Saturday after recently registering a case over

the alleged defrauding of State Bank of India of Rs 2929.05 crore, officials

said.

Teams of CBI conducted the searches at two locations in Mumbai on

Saturday -- the official premises of Reliance Communication Ltd., and

residential premises of Anil D Ambani, the agency said in a statement.

The action took place after the CBI registered an FIR on Thursday against Reliance Communication Ltd (RCom), Mumbai, its Director Anil D. Ambani,

unknown public servants and unknown others on the basis of a complaint from the

SBI, it said.

The searches took place at Ambani's residence 'Sea Wind' at Cuffe Parade

in Mumbai, sources said.

According to the SBI complaint, now part of the FIR, the company had an

outstanding of over Rs 40,000 crore to various lenders with the public sector

bank alone facing a loss of Rs 2929.05 crore, according to 2018 figures.

The agency has booked Ambani and RCom for allegedly committing offences

of criminal conspiracy, cheating and criminal breach of trust, the CBI has

said.

"It is alleged that the accused persons, in criminal conspiracy,

misrepresented and got sanctioned credit facilities from SBI in favour of

Reliance Communication Ltd," the CBI Spokesperson said.

She said it was also alleged that there was misutilisation and diversion

of loan funds, potential routing of loan funds, inter-company loan transactions,

misutilisation of sales invoice financing, discounting of bills of RCom by

Reliance Infratel Ltd., movement of funds through inter-company deposits, among

others.

According to the SBI complaint, now part of the FIR, Reliance

Communications Ltd. (RCom), Reliance Infratel Ltd. (RITL), a step-down

subsidiary of RCOM and Reliance Telecom Ltd. (RTL), a subsidiary of RCom,

cumulatively received Rs. 31,580 crores from banks.

The forensic audit done in 2020 mapped the utilisation of funds obtained

from banks which flagged deviations in funds received and utilised by RCom. The

utilisation was not as per the terms of sanction, it alleged.

It is alleged that Rs. 13667.73 crore (44 %) were utilised for

repayment of loans and other obligations to Banks and FIIs, and Rs 12692.31

crore (41 pc) were utilised to pay to connected parties.

The audit underlined that Rs. 6265.85 crore obtained from banks through

loans were utilised for repayment of other bank loans, Rs. 5501.56 crore of

loans were used for paying related and connected parties and investment of Rs.

1883.08 crore were made from the loans received from various banks, it alleged

while giving details of a number of other irregular transactions.

"Most of these investments were liquidated immediately and utilised

for payments to related and non-related parties," it said.

Capital advances given to Netizen Engineering Pvt. Ltd. -- a group

company of Reliance ADA Group -- were written off. Besides, fictitious debtors

were created and written off, the CBI Spokesperson said in the statement.

The audit had red-flagged a capital advance of Rs 5525 crore extended to

Netizen Engineering Pvt Ltd (Netizen) in 2015-16.

"In 2017-18, Netizen acquired two assets (one tangible worth Rs.

3041.24 crore and a receivable worth Rs. 3042 crore) from Millenium Private

Network Ltd. (MP'NL), one of which was immediately transferred to RCIL.

"The valuation of these assets is not clear. On transfer of this

asset, RCom wrote off the capital advance it had given to Netizen against

receivable balance from RCIL," the audit report submitted by the SBI for

registration of the FIR said.

In addition, multiple other accounts have been assigned to Netizen to

reduce its receivable balance by RCom and RTL, it is alleged.

The financial background of Netizen is not commensurate with the scale

of activities as shown in the books RCom. Netizen and RCOM appear to be closely

connected entities, the audit report alleged.

"Further money transferred by Reliance Jio Infocomm Ltd. (RJIO),

the flagship telecom arm of Reliance Industries Ltd (RIL) on the sale of

spectrum to RCom was also transferred to Netizen, which was further transferred

to entities with a weak financial background. Thus, the possibility that the

account of Netizen was utilised to siphon money could not be ruled out,"

it alleged.

The audit said that Netizen transactions do not appear genuine or conducted

in the normal course of business.

"Transactions appear to be an attempt at diversion of funds by

manipulation of books of accounts through fictitious accounts and fictitious

entries. It appears that they have committed the offences of misappropriation

of funds and breach of trust with dishonest intention," the audit report

alleged.

The CBI obtained search warrants from the Special CBI court, Mumbai, on 22 August, 2025, following which searches were conducted on Saturday.

The SBI had classified the account and promoter Anil Ambani as 'fraud'

on 10 November, 2020 and filed a complaint with the CBI on 5 January, 2021.

However, the complaint was returned in view of the 'status quo' order

dated 6 January, 2021, by the Delhi High Court.

Meanwhile, a Supreme Court judgement dated 27 March, 2023, in State Bank

of India and Others Vs Rajesh Agarwal and Others case mandated that lenders

provide borrowers with an opportunity to represent before classifying their

accounts as fraud.

The fraud classification in the account was reversed by the bank on 2

September, 2023.

The fraud classification process was re-run, and the account was again

classified as 'fraud' after following the due process as per the RBI circular

dated 15 July, 2024.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)

.png)