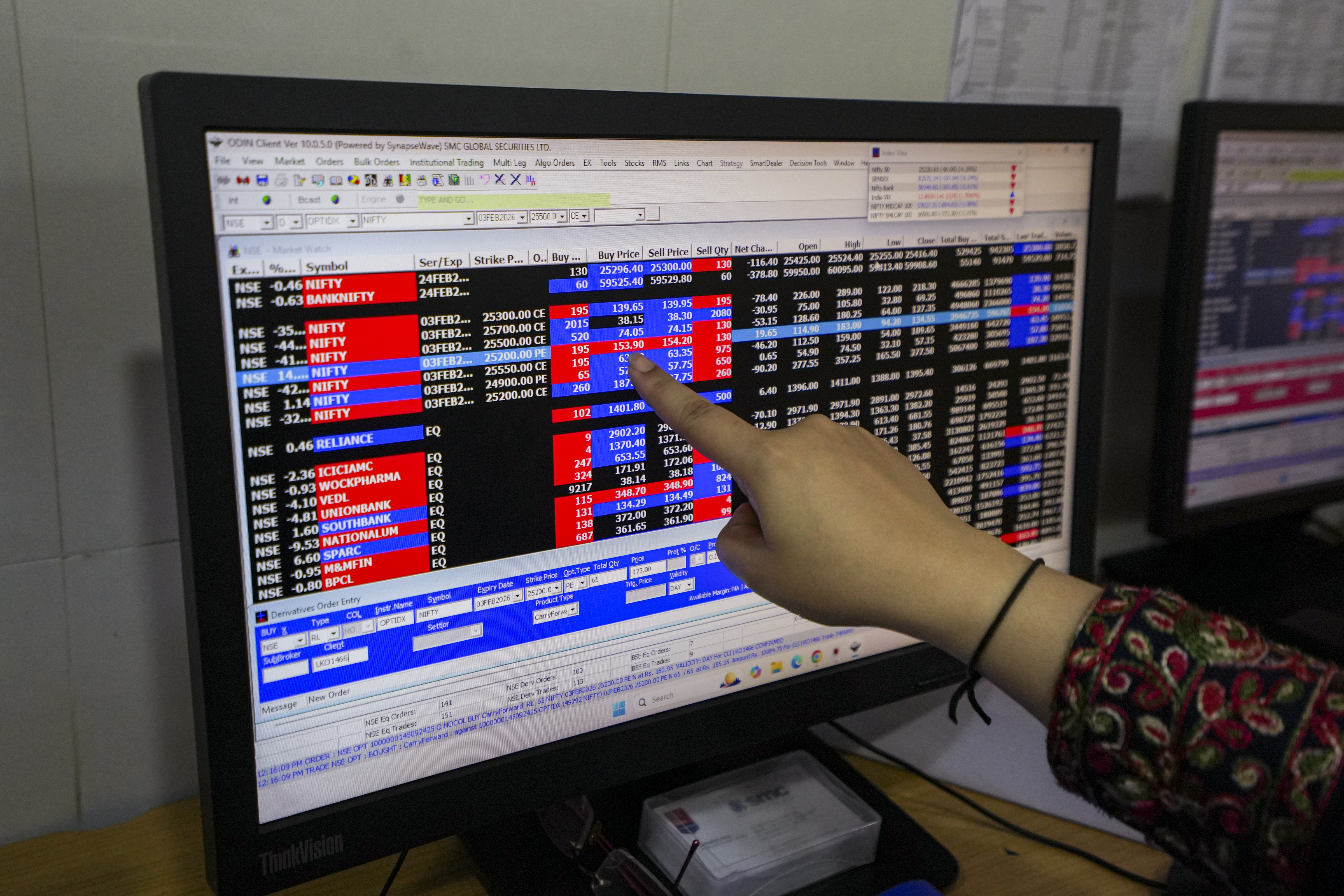

RBI keeps interest rates unchanged, cuts CRR

Its monetary policy committee, which consists of three RBI and an equal number of external members, kept the repurchase or repo rate unchanged at 6.5 per cent for a record 11th meeting in a row

PTI

-

RBI Governor Shaktikanta Das said Cash Reserve Ratio has been cut by 50 basis points to 4 per cent. PHOTO: PTI

Mumbai, 6 Dec

The Reserve Bank of India on Friday

kept its key interest rate unchanged citing inflation risks, but cut the Cash

Reserve Ratio that banks are required to park with the central bank, boosting

money with lenders to support a slowing economy.

With India's GDP seeing a

sharper-than-anticipated dip in the July-September period to 5.4 per cent --

its slowest pace in seven quarters, inflation on the uptick and rupee under

pressure, the Reserve Bank of India (RBI) had few choices to make.

Its monetary policy committee,

which consists of three RBI and an equal number of external members, kept the

repurchase or repo rate unchanged at 6.5 per cent for a record 11th meeting in

a row.

Four of the six members of the

panel voted for a status quo in rate, while retaining its policy stance at

"neutral". External members - Nagesh Kumar and Ram Singh - voted for

a quarter-point reduction.

RBI Governor Shaktikanta Das said

the Cash Reserve Ratio -- the proportion of deposits that banks must set aside

with the central bank -- has been cut by 50 basis points to 4 per cent,

effective in two tranches on 14 December and 28 December.

The cut will infuse Rs 1.16 lakh

crore into the banking system and will soften short-term interest rates and can

reduce the pressure on bank deposit rates. "At this juncture prudence and

practicality demands we remain careful," Das said. A status quo is

"appropriate and essential," he said, adding if growth slowdown

lingers beyond a point, "it may need policy support".

RBI lowered its growth forecast for

the year ending March 2025 to 6.6 per cent, from its earlier projection of 7.2

per cent. This even though Das said GDP slowdown bottomed out in the

July-September quarter and has seen a pick-up in subsequent months due to

festival spending and strong agriculture output.

It also raised its inflation

forecast for the current 2024-25 (April 2024 to March 2025) financial year to

4.8 per cent, from 4.5 per cent previously. Inflation has remained above the

RBI's 4 per cent target, with price gains accelerating to a 14-month high of

6.21 per cent in October.

Das, in his last monetary policy

before his second three-year term as Governor ends on 10 December unless it is

extended by the government, shunned calls from Finance Minister Nirmala

Sitharaman and Commerce Minister Piyush Goyal for lowering borrowing costs. Das

said the central bank will need to wait for data to confirm a decline in

inflation.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)