GST Council to consider taxation on insurance premium today

Sources said the fitment committee, comprising Centre and state tax officials, will present a report on GST levied on life, health and reinsurance premiums and the revenue implications

PTI

-

Even Transport Minister Nitin Gadkari wrote to Sitharaman on the issue.PHOTO:REPRESENTATIVE PHOTO

New Delhi, 8 Sept

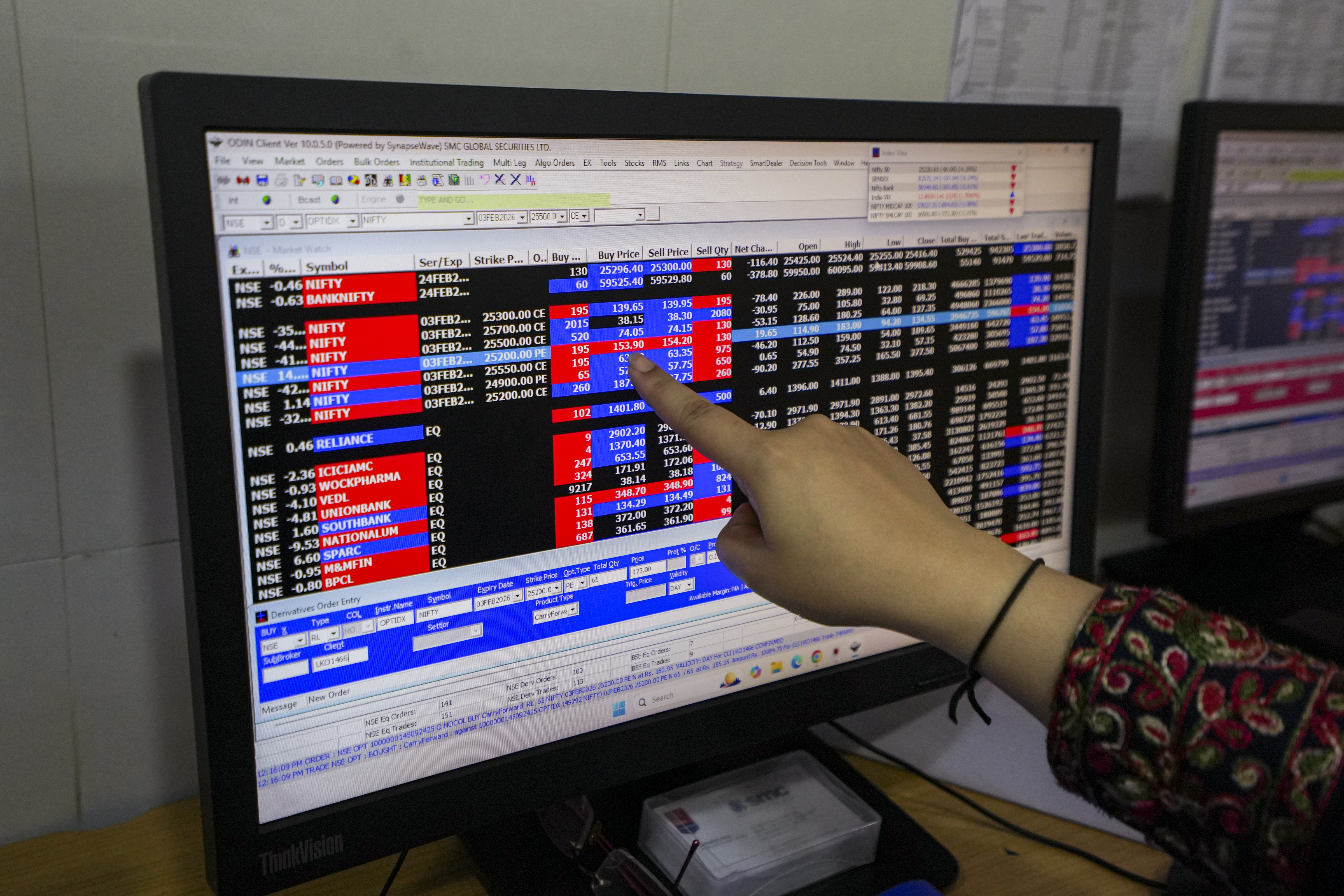

The goods and services tax (GST) Council on Monday is expected to

deliberate on a host of issues, including taxation of insurance premium, GoM's

suggestions on rate rationalisation, and a status report on online gaming,

sources said.

Sources said the fitment committee, comprising Centre and state tax

officials, will present a report on GST levied on life, health and reinsurance

premiums and the revenue implications.

GST Council, chaired by Finance Minister Nirmala Sitharaman and

comprising state ministers, will decide on whether to reduce the tax burden on

health insurance from the current 18 per cent or exempt certain categories of

individuals, like senior citizens.

The deliberations will also happen with regard to the GST cut on life

insurance premium.

In 2023-24, the Centre and states collected Rs 8,262.94 crore through

GST on health insurance premium, while Rs 1,484.36 crore was collected on

account of GST on health reinsurance premium.

The issue of taxation on insurance premium figured in Parliament

discussions with opposition members demanding that health and life insurance

premiums be exempt from GST. Even Transport Minister Nitin Gadkari wrote to

Sitharaman on the issue.

With regard to online gaming, Centre and state tax officers will present

a "status report" before the GST Council. The report would include

GST revenue collection from the online gaming sector before and after 1

October, 2023.

Sources said the Council would deliberate on the status of taxation on

the sector and any change in tax rates is unlikely.

Besides, the Council is likely to be apprised about the ongoing drive

against fake registration, the success of the drive and action taken against

such entities. The total amount of suspected GST evasion would also be

presented before the Council.

An amount of Rs 24,010 crore (state - Rs 8,805 crore + Centre - Rs

15,205 crore) of suspected tax evasion was detected during the special drive.

Also, the Council would approve notifications, including that of the

amnesty scheme, announced in the last council meeting. The various amendments

to GST law decided by the council in its previous meeting on 22 June were

passed by Parliament last month vide Finance Act, 2024. -PTI

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)