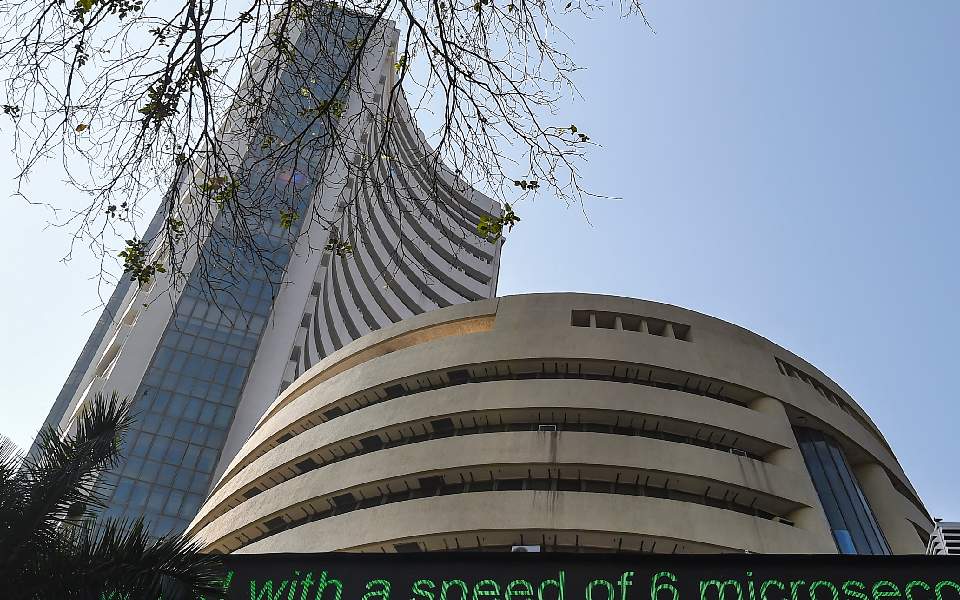

Sensex, Nifty hit all-time peaks after RBI's dividend announcement

The 30-share BSE Sensex regained the 75,000 level. It climbed 951.22 points or 1.28 per cent to reach its all-time high of 75,172.28. The NSE Nifty went up by 308.45 points or 1.36 per cent to 22,906.25 -- its record peak

PTI

-

RBI will pay a record Rs 2.1 lakh crore dividend to the government for the fiscal ended March 31, more than double of budgeted expectation

Mumbai, 23 May

Benchmark equity indices rallied on

Thursday, with the Sensex and Nifty hitting their lifetime peaks, after the RBI

approved the highest-ever dividend of Rs 2.11 lakh crore to the government and

supported by buying in blue chips Reliance Industries and HDFC Bank.

The 30-share BSE Sensex regained

the 75,000 level. It climbed 951.22 points or 1.28 per cent to reach its

all-time high of 75,172.28. The NSE Nifty went up by 308.45 points or 1.36 per

cent to 22,906.25 -- its record peak.

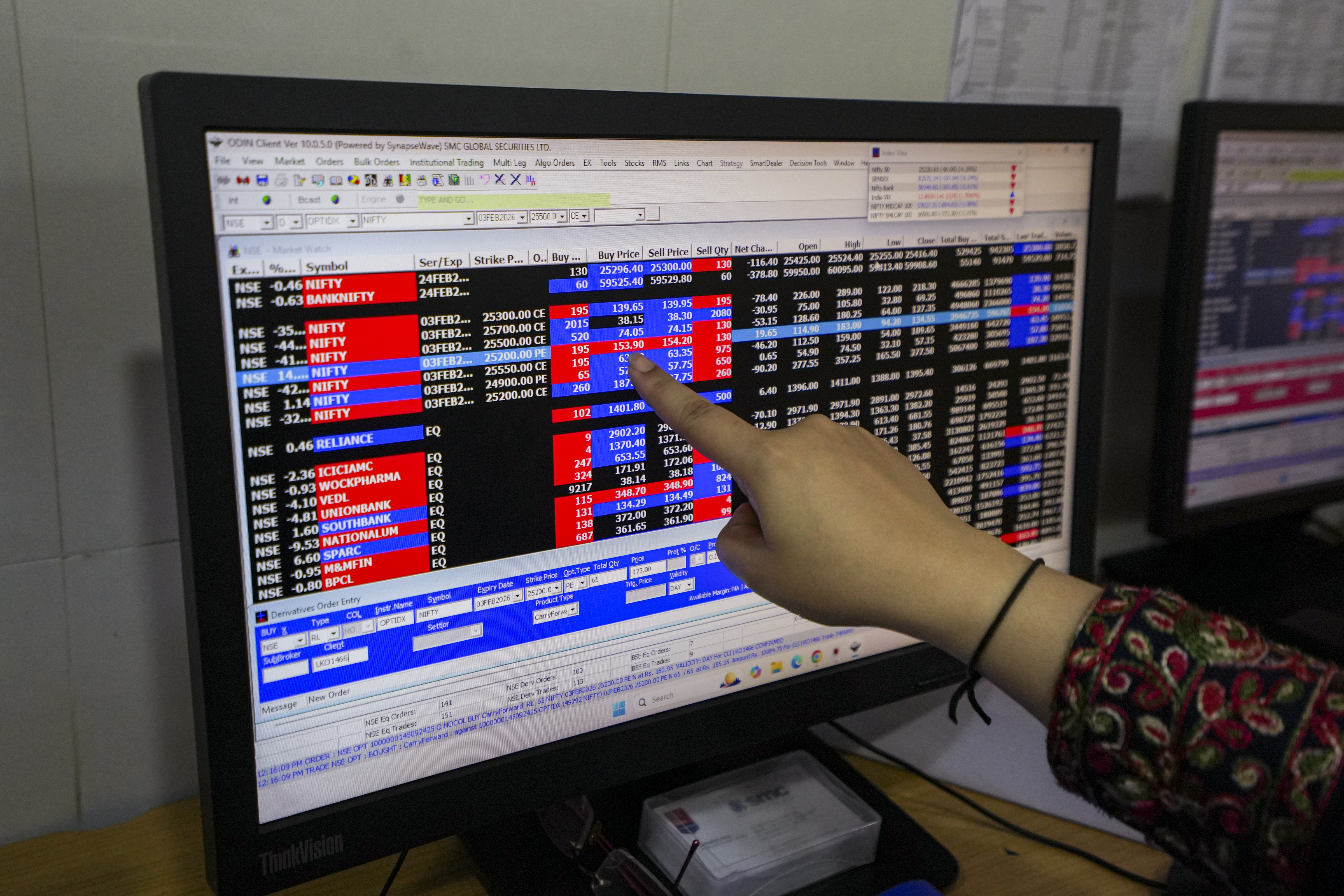

Among the Sensex firms, Larsen

& Toubro, Maruti, Mahindra & Mahindra, Axis Bank, IndusInd Bank, HDFC

Bank, Bajaj Finserv, State Bank of India and Reliance Industries were the major

gainers. PowerGrid, Sun Pharma, NTPC and JSW Steel were the laggards.

The Reserve Bank of India will pay

a record Rs 2.1 lakh crore dividend to the government for the fiscal ended

March 31, more than double of budgeted expectation, helping shore up revenue

ahead of a new government taking office.

The RBI board, at its 608th meeting

on Wednesday, approved the transfer of surplus, the central bank said in a

statement. "There are positives and negatives for the market today. The

biggest positive is the record Rs 2.11 lakh crore dividend from the RBI to the

government," said V K Vijayakumar, Chief Investment Strategist, Geojit

Financial Services.

This means the government can

reduce its fiscal deficit and step-up infrastructure spending, he added. "Brent

crude dipping below USD 82 is positive for India's macros," Vijayakumar

said. Global oil benchmark Brent crude declined 0.15 per cent to USD 81.79 a

barrel.

The negative for equity markets is

the US Fed meeting minutes, which indicate concern over the stubbornness of

inflation, he noted. In Asian markets, Tokyo traded in the green while Seoul,

Shanghai and Hong Kong quoted lower.

Wall Street ended in negative

territory on Wednesday. "The Nifty index has surged to a record high after

the Reserve Bank of India (RBI) announced a substantial Rs 2.1 lakh crore

dividend to the government. This development is a significant macroeconomic

positive for the market, with direct implications for the fiscal deficit and

bond yields," Santosh Meena, Head of Research at Swastika Investmart Ltd,

said.

Foreign Institutional Investors

(FIIs) offloaded equities worth Rs 686.04 crore on Wednesday, according to

exchange data. The BSE benchmark climbed 267.75 points or 0.36 per cent to

settle at 74,221.06 on Wednesday. The NSE Nifty advanced 68.75 points or 0.31

per cent to finish at 22,597.80.

Leave a Reply

Your email address will not be published. Required fields are marked *

.png)

.png)